Grail Securities (Switzerland)

Your Premium Address for Abnormal Returns

Gail's mission is to build client wealth by selecting high caliber U.S. stocks that have excellent probabilities of significantly outperforming the market.

Most investors overlook the fact that there are great and exciting opportunities in equities. This is because passive investing has given rise to a a plethora of index-tracking funds and EFTs. These in turn produce self-fulfilling prophecies that investors cannot consistently beat the market. In today's instant-communication age, this hypothesis is no longer valid, if ever it was. The Grail Equity Management System (GEMS) seeks out the real and latent opportunities that are created by stock market leaders, whose record of strong and consistent earnings growth provide the greater investment certainty needed to drive their prices higher.

Grail's large research portfolios set the standard that any investor subscribing to the Grail recommendations have a very high probability of not only beating the U.S. stock market consistently, but beating it significantly. Click on the Performance page to see an example of the sort of returns an investor can expect. 259 stocks out of the 3900 stocks GEMS monitors have been identified as STRONG BUYS, but any portfolio of five or more Grail stocks can deliver strong profits.

Click on the picture to see the Video on Vimeo

Self Investing

The video addresses the investor attitudes and their impact on risk and return.

Inefficient vs More Efficient Investing

Stock market risk explained

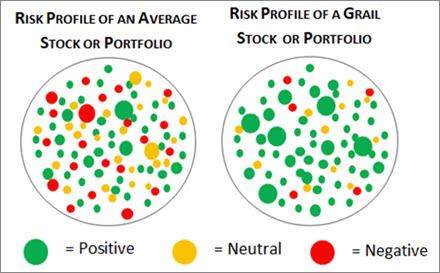

A risk profile is the result of a stock's underlying strengths and weaknesses, the sum of which is always priced-in by the market. Grail research has proven that high stock market returns are deeply rooted in successful corporations, because of their sustainable competitive advantages.

On 12 Oct 2020 of the stocks that make-up the S&P 500 53.5%, or 633 stocks, were making losses. The graph dipicting the risk profile of an average stock illustrates this inefficiency.

The Grail Ultra Alpha Portfolio, shown in the Performance page 21.5% of its 79 stocks are making losses! This is why the Grail graph is dominantly green.

Index funds are very popular with passive investors, but by their tracking a market index these funds have built-in ineficiencies, caused by the higher percentage of stocks in the surrogate index making losses.