Information

Grail's Investment Philosophy

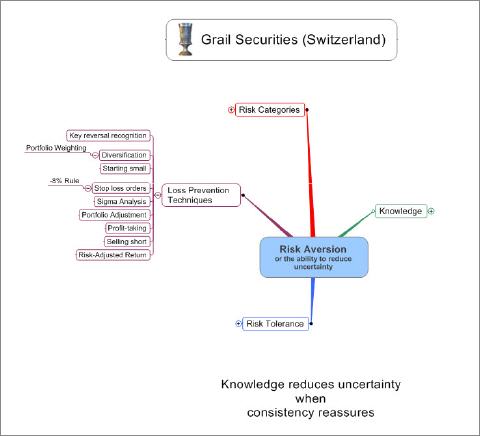

The consistency created by sustainable competitive advantage generates greater investment certainty.

Risk and Return

When it comes to investing in stock markets there are many misconceptions about risk and return that err on the side of caution. Of course, safety is particularly needed when knowledge and experience is in short supply. In fact, Warren Buffet correctly called it when he defined risk as not knowing what you are doing. The counter-argument to this is surely that knowledge not only reduces risk but is able to generate very high returns, such as those of Warren Buffet himself, Peter Lynch, John Neff, Martin Zweig, Benjamin Graham and other Wall Street legends.

In identifying alpha stocks Grail employs 6 of its own and 22 selection criteria used by these Gurus. The concrete results of this methodology are shown in Grail’s track record and in the research papers on the ‘Published Articles’ page that attempt to free investors from the restrictions imposed by these misconceptions.

To see our services click on the following Price Catalogue

The Risk Profile of the Grail Dynamic Portfolio

The volatility table and graph measures the historical Value at Risk of the Grail Dynamic against the S&P 500 and indicates that the Index has a higher volatility, but much lower performance.